Since the 70’s, the college town of Anne Arbor became one of the pioneers for the most lenient laws on possession in the nation. A 1974 voter referendum has made possession of small amounts a civil infraction subject to a small fine, and in 2004, another referendum was introduced to allow medical use. However, much stricter state laws were still enforced within the university property. Throughout the past decade, many cities in Michigan like Kalamazoo, Detroit, Flint, Jackson, have enacted reforms to decriminalize cannabis.

Today, Michigan is fully legal for recreational use.

After the recreational legalization took place in The Great Lakes State in 2018, Michigan had led a successful 2021 by closing with almost two billion in sales. As the industry ushers into the new year, many are filled with hope that the Michigan market will exceed last year’s performance, while some may have reservations about the growing pains that stemmed from the exponential growth.

A HISTORIC JOURNEY

From a medical to a fully recreational market

In November 2008, the state of Michigan passed the Michigan Medical Marijuana Initiative, legalizing medical use that enabled legal possession of up to 2.5 ounces for patients with medical conditions approved by a doctor. This change allowed patients or their caregivers to cultivate up to 12 plants, marking Michigan the 13th state the very first Midwestern state to legalize medical use. However, this initiative did not allow medical dispensaries to operate in the state. It was estimated that 75% of the dispensaries were operating under a legal grey area in 2013.

After 8 years following the passage of the Michigan Medical Marijuana Initiative, then Governor Rick Snyder signed three bills in September 2016 to allow the operation and regulation of medical dispensaries, apply a 3% tax on medical cannabis and include non-smoked categories such as topicals and edibles as well as extract products into the approved medical consumption list.

It was not long after an initiative appeared on Michigan’s November 2018 ballot that made Michigan the 10th state in the United States and the first in the Midwest to legalize recreational use. The Michigan Regulation and Taxation of Marihuana Act (MRTMA), also known as Proposal 1, was written by the Coalition to Regulate Marijuana Like Alcohol and got approved by voters by a 56-44 margin, legally allowing adults 21 and older to possess and grow. The passing of MRTMA also established a Marijuana Regulatory Agency (MRA), tasked to regulate the state’s adult-use establishments and licensees.

Following year after, the first recreational dispensary was opened in December 2019. And the rest, is history.

THE WORLD OF AN ADULT-USE MICHIGAN MARKET EVER SINCE

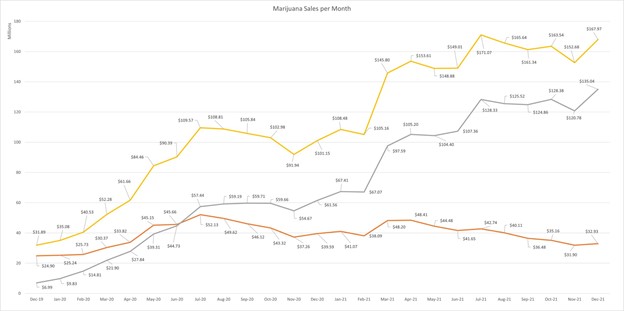

Since the first licensed recreational dispensary opened in December 2019, the total recreational revenue made more than $1.8 million. By adding medical sales into the mix, the number surged to a total of $2.8 billion.

In 2020, recreational sales reached $341 million while 2021 made a whopping $1.3 billion. Since January 2021, Michigan’s monthly recreational revenue has reached an average of $135 million. Just from December itself, the state saw more than $135 million in recreational purchases and about $33 million in medical sales. Sales peaked in July 2021, when it reached $171 million. While medical monthly sales have reduced by 23%, the recreational market has increased to almost 16%. If such increase is maintained over the next year, the market is on track to reach $2 billion.

According to state data, Michigan has made a total of $1.3 billion in recreational sales and $481 million in medical sales. In 2020, the state captured $31 million from recreational tax on top of the $15 million in licensing and application fees, not including the 6% in sales tax. In excise taxes alone, Michigan is most likely to hit about $131 million for 2021, which will be allocated to the development of the state’s infrastructure and public education.

Director of Michigan’s Marijuana Regulatory Agency (MRA) Andrew Brisbo predicted that the state’s market will grow to about 4 million consumers, who will spend about $3 billion annually by 2024. He added that the latest data indicates that the Michigan’s marijuana industry is supporting almost 33,000 jobs.

GROWING PAINS COMING FROM 2021

As market continues to grow exponentially, consolidation and corporatization would naturally take place. The number recreational retailers in Michigan started with 211 in the beginning of 2021 and ended the year with 432 licensed retailers, with most of the retail shares belonged to chain operators. While consolidation within the industry is deemed common, many players are concerned that it would create less competition and will affect the “little guys” in the market.

Prices fall when supply grows. The number of grow licenses in the state of Michigan has nearly tripled from 451 in January 2021 to 1,130 in December 2021. With up to four or more grow cycles a year, Michigan’s licensed business could potentially grow 7 million pounds in a single year. The average retail price per ounce of flower has decreased from about $285 per ounce in February to $184 per ounce in December.

Another notable concern about corporate consolidation when a recall was ordered by the MRA on almost every retail store in Michigan in relation to Viridis Laboratories, which perform safety testing a close to 60% of the state’s total supply. In November 2021, the MRA believed Viridis conducted poor safety testing, resulting in contaminated product making into the market. Although Viridis won a legal battle with the MRA resulting in a significantly reduced recall scope, the social and economic impact will surely take place in the future.

About Canna Brand Solutions

Canna Brand Solutions is an innovative custom packaging supplier and an official CCELL Distributor. We are a wholesale cartridge, battery, and packaging supplier, and more. Our passion to build lasting relationships with our partners motivates us to exceed your expectations, helping you grow your brand in this ever-evolving global industry.

With our deep experience in manufacturing and the cannabis industry, we offer adaptive custom packaging solutions, in-house design, and industry expertise to Cultivators, Extractors, Operators & Retailers.